I was once asked,

“Should I take a loan from the bank to invest in unit trusts? Afterall, they’re offering me a low rate of only 3.75% for 5 years”

Should we or shouldn’t we?

Generally, most banks quote a flat rate for personal loans, and not an effective interest rate. Flat rates are also used on car loans (Hire purchase loan).

So if they do quote a flat rate, we need to find out what the effective interest rate is first, to determine if it’s worthwhile taking that loan.

What’s a flat rate?

A flat rate is when interest is calculated on your full principal over the number of years in your loan tenure. So just multiply the rate with the principal, then multiply with the number of years, add back this amount to the principal, then divide with the number of months that you need to pay up the loan.

For example, if you are offered a loan amount of RM 40,000 and the flat rate is 3.75%. Tenure of the loan = 5 years.

Interest payment:

Rm40,000 x 3.75% = RM 1,500 per year

Total interest paid:

RM 1,500 x 5 years = RM 7,500

Instalment amount to be paid per month = (RM 40,000 + RM 7,500) / 60 months = RM 791.66

Use a financial calculator to find out the effective interest rate.

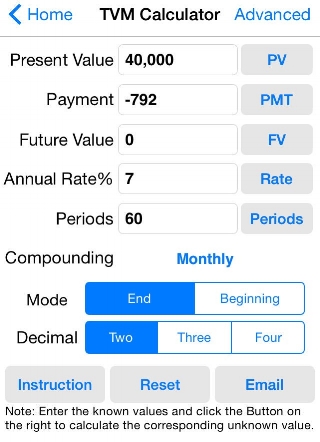

I like to use the EZ Calculators app which you can download on IPhone or Android phones.

Key in..

Present Value = 40,000

Payment = the loan instalment = -792

(a minus in front because we’re paying this amount)

Future Value = 0 (because at the end of the tenure of the loan, we don’t owe anything, anymore)

Period = 60 (because we are paying monthly, thus it has to be in number of months)

Make sure the compounding is set to ‘monthly’ in the financial calculator (as shown in the image)

I round up the instalment amount to RM 792 as most banks do that.

Click on ‘Rate’

…and you will get the effective interest rate of 7%.

(You could also borrow some online calculators. I found a couple.....click here or here... to get your effective interest rate from your flat rate)

______________

So now, to answer the question, “Should I take a loan from the bank to invest? Afterall, they’re offering me a low rate of only 3.75% for 5 years”.

I wouldn’t.

If my loan rate is 7% and my return from my investments give me return of 8%, why bother.

Unless you are absolutely sure that your investments can give you at least 15-18% p.a. (which is a nett of 8-11% after deducting our loan rate) then it's ok to borrow to invest. However under which circumstances are we absolutely sure that we can get 15-18% p.a after 5 years?

Generally, it’s not healthy to borrow to invest.

Would you rather borrow and pay interest or save and earn interest?

Remember that to be regarded as rich and financially free, we need to have a healthy NET WORTH. (total assets less total liabilities) and be debt free.

Thus, borrowing to invest means that not only do we increase our assets, we increase our liabilities too…